Did you know that over 70% of women feel unprepared for retirement? This statistic is alarming, but it also highlights an urgent need for financial empowerment. Investing, especially through dividend strategies, can be a powerful tool to build a secure financial future, and it's never too late to start.

This article explores dividend investing for passive income, specifically tailored for women over 40. We will delve into building a stock portfolio for slow growth, compare stocks vs. ETFs, and address common concerns. But first, let's address a crucial question: Why should women prioritize passive income strategies? The answer lies in securing long-term financial stability and building a future free from financial anxieties.

Here are three key reasons why dividend investing is perfect for women over 40:

- Regular Income Stream: Dividends provide a consistent income flow, acting as a safety net and supplement to existing income.

- Long-Term Growth Potential: Dividends reinvest automatically, compounding your wealth over time.

- Reduced Risk: A diversified portfolio minimizes risk while still delivering significant returns.

Understanding Dividend Investing for Passive Income

Dividend investing involves purchasing stocks in companies that regularly pay out a portion of their profits to shareholders. This passive income stream can be a significant part of your retirement plan. How does this compare to relying solely on savings accounts or fixed-income investments? The answer is clear: dividends provide the potential for much higher returns.

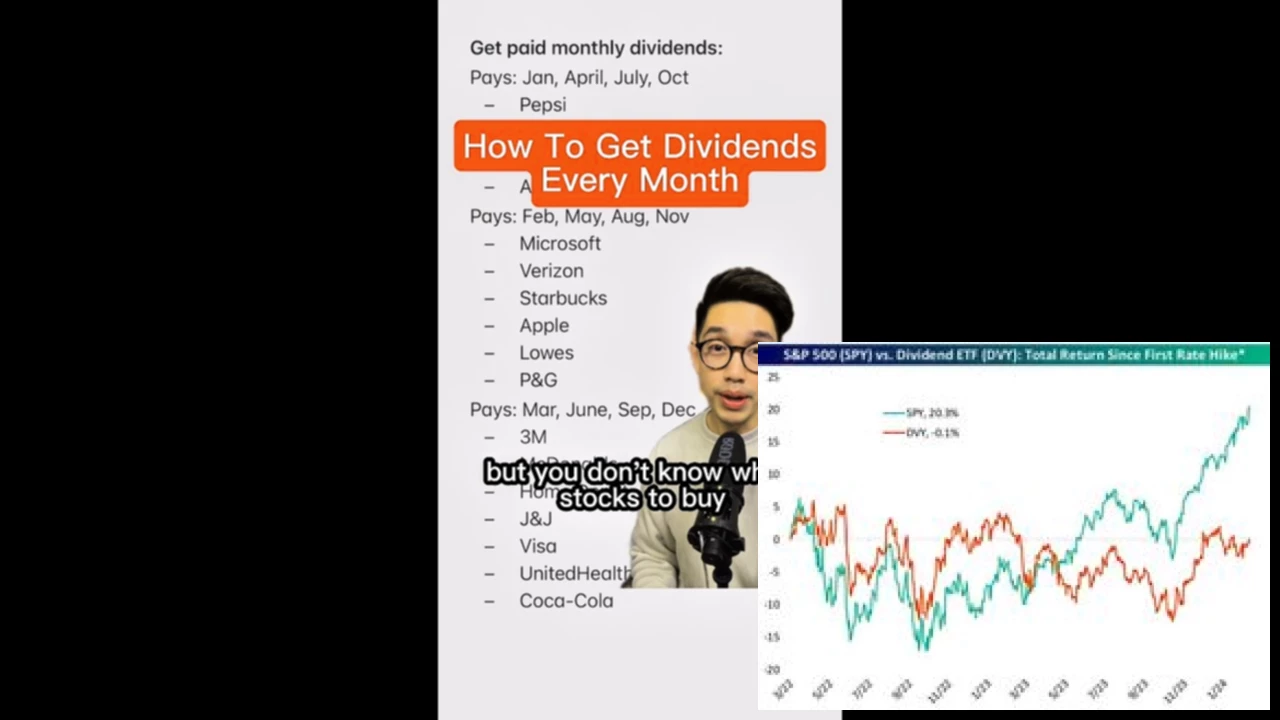

Stocks vs. ETFs Made Simple

| Feature | Stocks | ETFs |

|---|---|---|

| Investment Approach | Individual company shares | Basket of stocks or bonds |

| Risk | Higher individual stock risk | Lower, diversified risk |

| Management | Requires active research | Passive, managed by professionals |

Building a Stock Portfolio for Slow Growth

Creating a diversified stock portfolio tailored to your risk tolerance and financial goals is crucial. Consider a mix of blue-chip stocks (established, stable companies) and growth stocks (companies with high growth potential). Remember, consistency is key; regularly contribute to your portfolio even with small amounts.

Many women over 40 are concerned about market volatility. How can we mitigate this risk? By focusing on slow, steady growth, rather than chasing quick gains. Dividend investing is an excellent tool to help manage this process and reduce volatility. Building a passive income stream provides financial security.

Investing as a Woman Over 40: Addressing Common Concerns

"Don't be afraid to invest. Start small, learn as you go, and remember that every step you take is a step towards financial freedom." - Jane Doe (Financial Advisor)

Frequently Asked Questions

- Q: How much money do I need to start investing? A: You can start with even small amounts. Many brokerage accounts allow for fractional shares.

- Q: What are the risks of dividend investing? A: Like any investment, there's risk. However, a diversified portfolio and long-term approach can mitigate these risks.

- Q: How do I choose which stocks to invest in? A: Research companies, consider their dividend history and financial stability, and diversify your investments.

- Q: Is it too late to start investing at 40? A: Absolutely not! It's never too late to start working towards your financial future.

- Q: How do I track my investments? A: Most brokerage accounts provide online tools to monitor your portfolio's performance.