A staggering 70% of women over 50 lack a comprehensive estate plan. This leaves their assets vulnerable and their loved ones facing unnecessary burdens. Don't let this statistic be your reality; taking control of your future is empowering and essential.

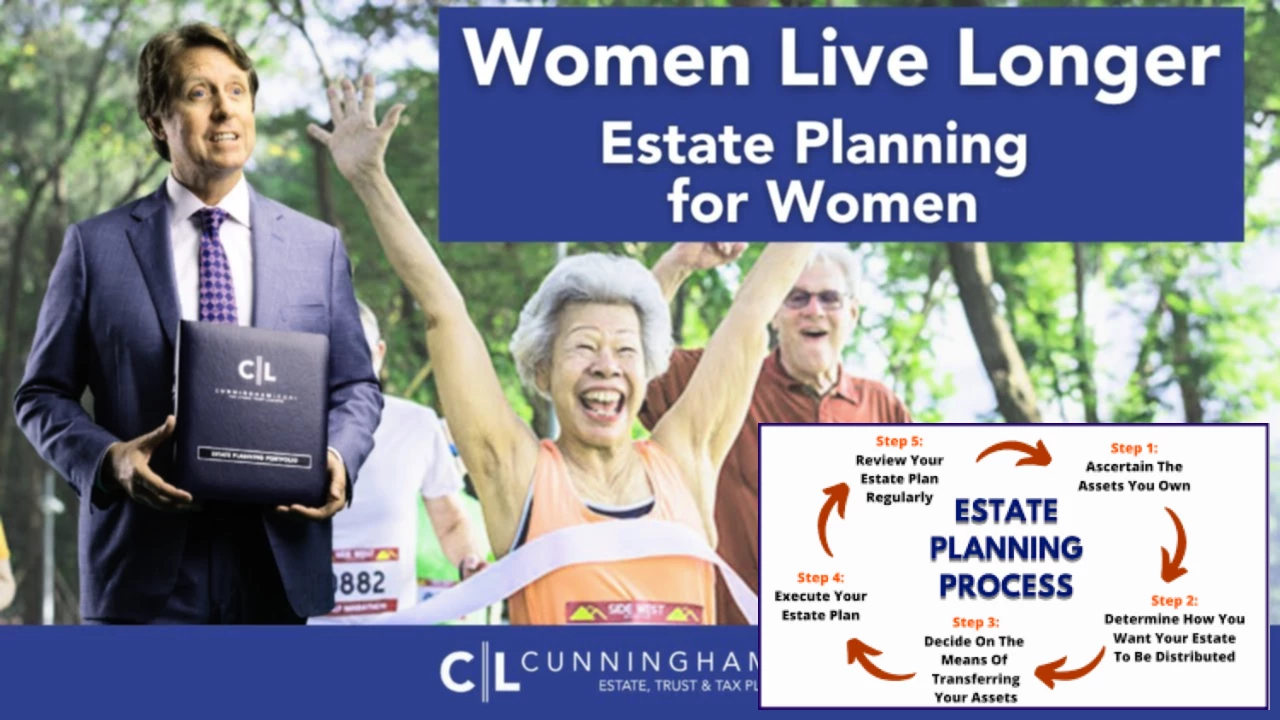

So, what exactly *is* estate planning, and why is it crucial for women over 50? It's the process of legally organizing your assets and making plans for their distribution after your death or incapacitation. It ensures your wishes are followed, protecting your family's financial well-being and minimizing potential conflicts.

Here are three key areas to focus on:

- Will: A legal document outlining how your assets will be distributed.

- Living Trust: A legal entity that holds and manages your assets, avoiding probate.

- Power of Attorney: Designates someone to manage your finances if you become incapacitated.

Understanding Estate Planning

Many women over 50 face unique challenges, such as being primary caregivers and potentially having less financial experience than their male counterparts. This makes proactive estate planning even more crucial. How can we effectively address these challenges and ensure our assets are protected?

Will vs. Living Trust: A Comparison

| Feature | Will | Living Trust |

|---|---|---|

| Probate | Usually requires probate | Avoids probate |

| Cost | Relatively inexpensive to create | More expensive to set up |

| Privacy | Public record | Private |

Protecting Your Assets for the Future

Protecting your assets isn't just about money; it's about securing your legacy and ensuring your family's financial stability. This includes considering long-term care costs, which can quickly deplete savings. How can we best plan for these potential expenses while still safeguarding our assets?

Consider a simple living trust, often a better option than a will for avoiding probate hassles and keeping your affairs private. But how do you decide which option is right for *you*? The best approach involves assessing your specific needs and seeking professional guidance.

Avoiding Probate Hassles

Probate, the legal process of distributing assets after death, can be expensive, time-consuming, and public. A living trust offers a way to sidestep these hassles, offering greater control and privacy.

As we age, the need for a comprehensive estate plan becomes even more apparent. Just as we prioritize our physical health, we must prioritize our financial and legal well-being. Think of your estate plan as a roadmap guiding your loved ones through a potentially difficult time, ensuring a smoother transition and preserving your legacy.

"Failing to plan is planning to fail." - Benjamin Franklin

Frequently Asked Questions

- Q: How much does estate planning cost? A: The cost varies depending on complexity, but many online services offer affordable options for simple wills.

- Q: When should I start estate planning? A: It's never too early! The sooner you start, the better prepared you'll be.

- Q: Do I need an attorney? A: While not always necessary for simpler plans, an attorney can provide valuable guidance and ensure your documents are legally sound.

- Q: What if my circumstances change? A: Regularly review and update your estate plan as your life changes.

- Q: What about digital assets? A: Don't forget to include passwords and access information for your online accounts.