Did you know that the average family spends over $25,000 annually on healthcare? This staggering figure highlights the urgent need for effective financial planning. Health Savings Accounts (HSAs) offer a powerful solution, allowing families to save pre-tax dollars for qualified medical expenses.

Understanding the intricacies of an HSA can seem daunting, but the potential rewards are immense. But how does an HSA work, and how can families maximize its advantages? Let's delve into the details.

Three Key Advantages of Using an HSA for Family Healthcare:

- Tax Advantages: Contributions are pre-tax, reducing your taxable income.

- Investment Potential: Funds can grow tax-free.

- Flexibility: You control the funds, using them for eligible medical expenses as needed.

HSA Benefits for Families

HSAs offer significant advantages for families. Not only do they provide tax benefits, but they also empower families to proactively manage their healthcare finances. Think of it as a dedicated savings account for future medical needs, growing tax-free year after year.

One of the key questions many parents have is, "How much can I contribute to an HSA annually?". This limit varies year to year, so it is important to consult the IRS guidelines.

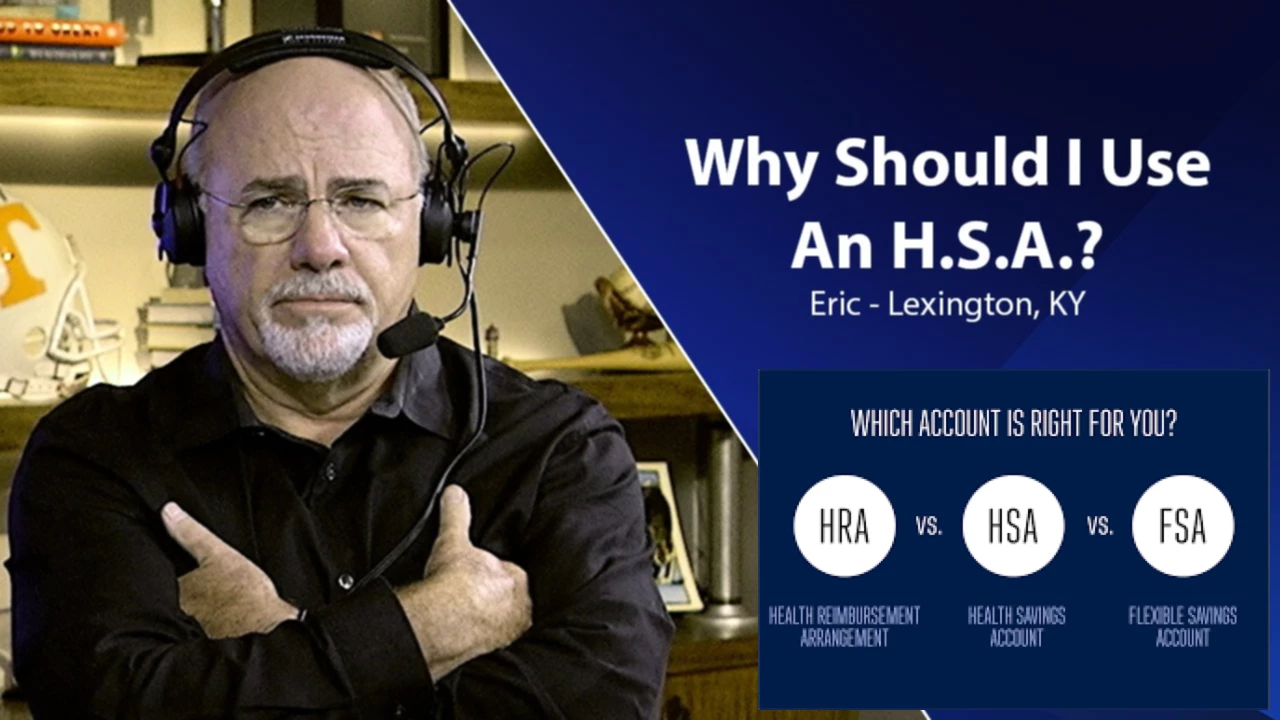

HSA vs. FSA: A Detailed Comparison

Many people confuse HSAs with Flexible Spending Accounts (FSAs). While both offer pre-tax savings for medical expenses, they differ significantly. The following table illustrates the key differences:

| Feature | HSA | FSA |

|---|---|---|

| Ownership | You own the account. | Employer-owned. |

| Rollover | Funds roll over year to year. | Funds generally do not rollover. |

| Eligibility | Requires a high-deductible health plan (HDHP). | Offered by some employers regardless of health plan. |

How to Use HSA Funds Effectively

Using your HSA funds wisely involves planning and awareness of eligible expenses. Remember, the goal is to leverage these pre-tax dollars to manage healthcare costs efficiently.

Proactive planning, such as budgeting for potential medical needs and investing your HSA funds for long-term growth, can significantly enhance the benefits.

Saving Pre-Tax Dollars for Medical Expenses

The power of saving pre-tax dollars for medical expenses cannot be overstated. Every dollar you save is a dollar you're not paying in taxes. This translates to more money for your family's overall financial well-being. But how do you start? The first step is to understand the eligibility requirements for your HSA, which depend on your health insurance plan.

But isn't it complicated? Not necessarily. Numerous resources, including your employer's benefits department and financial advisors, can provide clear and comprehensive guidance.

Understanding Health Savings Accounts (HSAs)

An HSA is a powerful tool, allowing families to save and invest for future medical expenses. The tax benefits alone make it a worthwhile financial strategy. But remember, using an HSA requires strategic planning and understanding of its rules and regulations. However, the long-term financial advantages far outweigh the initial learning curve.

"Investing in your family's health through an HSA is an investment in their future financial security. It’s a proactive, empowering approach to managing healthcare costs."

Frequently Asked Questions (FAQ)

- Q: Can I use my HSA for my child's medical expenses? A: Yes, as long as the expenses are considered qualified medical expenses.

- Q: What happens to my HSA funds if I change jobs? A: You retain ownership of your HSA funds.

- Q: Are there penalties for withdrawing funds for non-qualified expenses? A: Yes, you'll be subject to income tax and a 10% penalty (before age 65).

- Q: Can I contribute to an HSA after I retire? A: Yes, as long as you're enrolled in a high-deductible health plan (HDHP).

- Q: How do I choose the right HSA provider? A: Consider factors such as fees, investment options, and customer service.